COLLECTIVE PSYCHOLOGY AND MONETARY DYNAMICS

IN THE WRITINGS OF MAURICE ALLAIS

SOME KEY POINTS FOR UNDERSTANDING THE ORIGINALITY OF HIS APPROACH

By Christian GOMEZ

The unsuspecting reader who embarks on the models and theories of Maurice Allais as set out by their creator is liable to be disconcerted both by the originality of his approach to monetary phenomena, which clashes with what most people have been taught and believe to be fact, the mathematical formalization of the models, which, while not actually insufferable, is certainly laborious, and the nature of some of the assumptions made, which can only be fully grasped against a background of considerable familiarity with his thought.

What must be constantly borne in mind is that Allais’s approach is not only exclusively inductive, quite untrammelled by the received ideas of the day, but also that it strives to respect all the constraints of the scientific method (1968, 1989, 2001):

- Rigorous approach to the facts, including all possible observable situations, irrespective of period or country;

- Pursuit of unitary behavioural models, i.e. of models able to represent all the observed facts in a single theoretical framework, irrespective of place, time or institutional context;

- Pursuit of models that are invariant, i.e. based on identical parameters for all cases, human psychology being supposed to be everywhere the same, apart from shift constants to take account of the variability of the institutional contexts or of initial starting conditions for the calculation of indicators integrating records of past events;

- Explanation, when appropriate, of statistical patterns brought to light by the other theories in certain situations, which must then appear as specific cases of the proposed general theory.

Allais’s monetary approach is a prime example of the application to economics of the scientific method used in the so-called “hard sciences” such as physics.

It will be presented here without regard for the chronological order in which it was progressively constructed, with a view to enabling the entire general architecture of its final form to be grasped in a few broad brushstrokes, structured around two panels of which the first covers research into the general laws of economic psychology and behaviour and the second develops the way in which the evolution of this psychology, by its impact on behaviour, influences economic activity both in its cyclical fluctuations and in its long term evolution.

This presentation will not use sophisticated mathematical formulation.

I – Hereditary conditioning and economic behaviour: in search of unitary and invariant laws

Unlike most economic theories past and present, Allais does not regard the psychology of economic agents as a datum on the basis of which they will make arbitrages in the light of their budgetary constraints (income, wealth) and of the relative prices of goods or assets. On the contrary, for Allais the changes in the psychology of the agents are the key to the explanation of economic phenomena, while other possible factors belong only to the second order. This is what he strives to achieve by his approach to the supply and demand for money as well as to rates of interest.

“Hereditary” conditioning as the basis of how the psychology of economic agents operates.

Underlying the evolution of the psychology of economic agents is the remembrance of past events which will be formalized by Allais in the construction of a “Coefficient of Psychological Expansion ”. This is characterized by two fundamental features which highlight the complexity of the effect in question:

The hereditary conditioning of economic agents

Economic agents make their decisions depending on their perception of the economic situation and empirical analysis shows that this is above all guided by the record of past events, approximated in Allais’s model by the rates of variation in overall expenditure [1], the effect of each of these variations gradually abating via a rate of forgetfulness per unit of time such that an influence is so much the weaker as it is further removed in time. Hence this coefficient is the sum of all these effects, the importance of each being weighted according to how long ago it happened.

The relativistic effect, taking into account the variability of the effects of memory

This effect of memory is complex, as the phenomenon of remembrance itself depends on the economic situation. For in fact, memory fades faster (increase in the rate of forgetfulness per unit of time) as the economic situation is more unsettled and agitated, so that the adaptation of economic agents to the new conditions must take place faster and faster as in hyperinflations. So, in Allais’s conceptualization, coefficient will depend on past rates of variation in global expenditure, subject to weightings (rates of forgetfulness per unit of time) which themselves depend on the perception of the economic situation, i.e. of index

itself [2]. Thus the retrospective horizon of economic agents liable to influence and modulate their current behaviour may vary from a few years (very low rate of forgetfulness) under relatively unchanging economic conditions, to a few days or even a few hours (very high rate of forgetfulness) in situations of hyperinflation.

This coefficient representing the state and evolution of the collective psychology at each point in time is the keystone of Allais’s entire construct as it is what controls both economic behaviour and interest rates.

STRUCTURAL RELATIONS BETWEEN THE COLLECTIVE PSYCHOLOGY REPRESENTED BY THE COEFFICIENT AND THE ECONOMY THROUGH THREE ESSENTIAL VARIABLES

In the context of his general conception of economic and monetary phenomena, Allais sought to integrate into a single general explanatory framework: demand for money, money creation via credit and rates of interest, linking them all to collective psychology as represented by his “coefficient of psychological expansion ”.

Allais’s “fundamental psychological law”: the Hereditary, Relativistic and Logistic function of the demand for money (or HRL theory) – (as from 1965 , see bibliography)

For the traditional theories, the demand for money on the part of economic agents is essentially explained by an arbitraging process against other assets under a constraint of resources (income or wealth) and there are as many functions as there are countries and situations (be they normal or exceptional such as deflationary crises of the 1929 type or inflationary crises of the “hyperinflationary” type). Allais’s contribution is to show that all these theories are in fact based only on statistical correlations utterly devoid of explanatory value whereas it is possible to explain the demand for money in the framework of a unitary and invariable theory, i.e. an authentic “fundamental psychological law”, the scientific significance of which is quite different from that which Keynes thought he could identify between consumption and income in his “General Theory” (1936).

For Allais, economic agents, in planning the money balances they will need to satisfy their planned spending for the period they have set, constantly adjust the former (desired balances

For Allais, economic agents, in planning the money balances they will need to satisfy their planned spending for the period they have set, constantly adjust the former (desired balances ) to the latter (expenditure

), i.e. they adjust the ratio

in accordance with their perception of their economic environment which is itself reached via coefficient

. This is the function

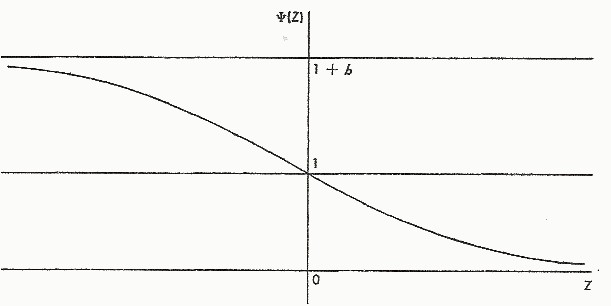

which has a highly characteristic form:

- The more their perception of the economic situation is changeable and erratic, the more economic agents will lower their money balances relative to their expenditure and vice versa; (

is therefore a decreasing function of

).

- Whether upwards or downwards, this behaviour of money balances meets limits, which explains the logistic form: As

rises, operators will endeavour to reduce their balances as far as possible, but the limit of the ratio

cannot be less than 0; as

falls, the value of this ratio cannot go beyond a certain limit which is the value of the financial wealth itself.

This fundamental function is psychological in nature. It is the same for all countries, all periods and all situations. In order to take account of the structures specific to each country (the organization and efficiency of the payment system), Allais simply introduced a shift constant to be estimated, , which is the value of the ratio

under stationary conditions, i.e. when

.

The function of the supply of money/creation of bank credit: the endogenous nature of money creation

Like the demand for money, the supply of money – i.e., to Allais’s mind, the creation of money via bank credit – is itself entirely linked to the collective psychology of economic agents. The evolution of bank credit is at all times the resultant of two aspirations: the banks’ desire to lend and their customers’ desire to borrow. While it is true that the banks may be influenced by the greater or lesser ease of gaining access to reserves, it is clear that both protagonists are subject to the same ongoing climate which is, at root, the determining factor from which the supply of money results.

Naturally, in the light of the specific characteristics of institutional systems and of interactions between budget policy and monetary policy proper to each country, it was difficult for Allais to entertain the same ambitions of generality as for the money demand, but for this very reason, to take account of the various scenarios while focussing on this endogeneity of money, he proposed, in his last specification, an explanation of the latter in which two elements are distinguished: (1) a long-term trend in the volume of money or of the directly calculated monetary base, (2) fluctuations about this trend essentially linked to the collective psychology in accordance with an increasing function of logistical form

, i.e. limited upwardly (at the top of the cycle, as the banks cannot inordinately increase their supply of credit relative to base money, nor indeed the level of their credit risks) and downwardly (when the cycle is at low tide, as the banks cannot accumulate unproductive reserves without being tempted to re-invest them on the financial market, thereby boosting the money supply).

Allais presented much less empirical research on this function than on the demand for money (essentially concerning the US) and, in the applications of his model of monetary dynamics, he considered the supply of money as a datum (use of observed data). Nonetheless it remains essential to understanding his explanation of the instability of market economies, as we shall shortly see.

Rate of forgetfulness and rate of psychological interest: a stroke of genius?

To all these original contributions to monetary theory, Allais was to add another, major one: an operational formulation of the psychological rate of interest, i.e., to borrow von Mises’s expression, “the ratio in the mutual valuation of present goods as against future goods”. Already in 1947 Allais had shown that interest is neither the price paid for the services of capital, nor an incentive to save or a reward for abstinence, but is probably due to an intrinsic psychological disposition of economic agents. Already at that time this harmonized with authors such as Wicksell (“natural rate of interest”) or von Mises (with his notion of “originary interest”), but, like them, he had no operational formulation of this rate supposed to guide all the others. It was in the 70s, in the wake of his work on demand for money, that Allais glimpsed the empirical solution to the problem: the parallel between the psychological processes of forgetfulness and the mental mechanisms involved in the appraisal of future events and hence in the discounting process, i.e. the identification of the rate of forgetfulness with the rate of interest. And since he already had a formulation for the rate of forgetfulness () in the context of the HRL theory, this automatically provided him with a theory of the rate of psychological interest (

) on which to base a general theory of all the rates of interest, thereby demonstrating the importance of the psychological perception of the environment (

) to a new key economic variable. The more perception inclined towards a remembered expansion of global expenditure (and not merely of prices, as in the widely accepted theory) the more the rate of psychological interest would have to rise, and vice versa in the event of perception of a deflationary environment, coupled in both cases with a lag effect linked to the remembrance process.

As always with Allais, it was the observation of facts that guided his thinking. First he noticed that the order of magnitude of the average rates of forgetfulness was similar to the rates of interest identified by historical analysis of different situations, including under hyperinflations! Thereupon the logic of the approach itself led him to formulate this hypothesis of a link between the backward- and forward-looking horizons of economic agents:

- When the agents, confronted by economic conditions changing more rapidly than usual, take into account past events over shorter and shorter periods in their grasp of the present situation (increasing rate of forgetfulness), it is natural to infer that the same uncertainty will affect their vision of the future by shortening the period within which they are ready to commit themselves for a given reward (increased discount rate);

- On the other hand, when economic conditions are stable and reassuring for individuals, their ongoing appraisal of the present situation will send its roots deeply down into the past (low rate of forgetfulness per unit of time) and it seems likely that the same will apply to their attitude towards the future, leading them to accept lower rewards over longer periods (low discount rates).

*********

These three functions being well established, Allais was now able to arrange all the instruments needed to explain the entire economic and monetary dynamic of market economies in all their dimensions.

II- The concepts of economic and monetary dynamics in Allais’s writings

Allais’s originality is displayed not only in his entirely new approaches to economic behaviours but also in his general notion of their interaction with a view to explaining how the economy acts both in its disequilibria, via a new, operational explanation of the cyclical fluctuations of economic activity and of crises, and in its long-term dynamic by determining the conditions of optimal growth in terms of optimal capital stock and of monetary policy.

The indispensable preconditions of economic fluctuations and the intrinsic causes of cyclical instability

The economic literature contains theories galore that seek to explain cyclical fluctuations in activity and the famous periodic crises, witness already in 1937 works such as Gottfried Haberler’s “Prosperity and Depression” which Allais held in high regard. To get to the bottom of the issue, Allais, for his own part, set out to identify the indispensable preconditions of every change in global expenditure, by restating the quantity theory of money under an operational form: “the fundamental equation of monetary dynamics” (FEMD). This would enable him to demonstrate, using the findings of his earlier research, how the behaviour of the supply and demand of money underlie the instability of the market economies when the money supply responds to the “mood” of economics agents, i.e. to their feelings of optimism or pessimism.

From Fisher’s quantitative equation to the fundamental equation of monetary dynamics

Fisher’s quantitative equation [3], stipulating that global expenditure (i.e. the prices of goods, services and assets, multiplied by their respective quantities) is generated by the number of times the monetary units in circulation (

) change hands (velocity of circulation

) is a mere truism by which only the velocity of monetary circulation can be defined. It can only become a theory by positing hypotheses as to what causes alterations in the velocity of circulation and in the money stock. This is precisely what Allais undertook to do, entirely altering the approach perspective in order to build a truly explanatory theory of fluctuations in global expenditure by identifying its determinant factors. In fact, the velocity of circulation as such is a statistical magnitude without any psychological content of its own as it is merely the outcome of behaviour which corresponds to genuine motivations and therefore calls for explanation.

By considering two periods , each representing the average lapse of time in a particular community between the receipt

of an income and its expenditure

, Allais took his stand at the transition-point

between these two periods in order to determine the choices available to any economic agent in this community when, at time

, he draws up his spending plan, whether in real goods or in financial assets (Allais, 1968, new edition, 2001, p. 960).

As a matter of fact this agent may chose to spend his income/receipts from the preceding period in which case his expenditure does not vary from period to period. But if he so chooses, he may also spend more (or less) than he in fact earned, by drawing on three possible sources:

- By modifying the balances he holds: he can draw on (or increase) his liquidities by decreasing (or increasing) the average permanent money balance he holds in order to meet his spending plan and any unforeseen needs that may arise. In Allais’s terminology, this means that his actual balance is greater (or less) than his desired balance – i.e. he has an excess (or shortfall) of money held, which he will add to (or subtract from) his income in the context of his expenditure plan for the period between

and

;

- By modifying his bank financing levels: He may also turn to new loans (or reimburse existing ones) with the banks, thereby injecting new purchasing power into the economy (or withdrawing existing purchasing power), other things being equal [4], for when bank loans are obtained, it is new means of payment that are made available to him, not pre-existing resources that are transferred to him (real savings);

- By issuing fixed term IOUs or endorsing existing IOUs: Another means of payment, if it is accepted by the creditors, is to issue a recognition of indebtedness (bill of exchange) or to re-circulate, via endorsement, bills in the debtor’s possession, by way of payment (at term) of his own expenditures.

The conclusion which follows from this is that is only possible to conceive of fluctuations in value-for-value global expenditure as a result of three key factors: (1) a discrepancy, at the point in time when the decision is made, between actual balances (

) and desired balances (

), i.e. (

), (2) from period to period, a variation in the volume of money in circulation (

) and (3) a variation in levels of non-bank debt (

). Once again this equation would be a mere tautology like Fisher’s if Allais had not previously demonstrated the existence of stable and unvarying functions for the demand and supply of money. Non-bank debt levels, concerning which available data is scarce, will be treated as a secondary factor and disregarded.

Interaction of the functions of demand and supply of money: the first and only explanatory model of cyclical fluctuations based on a process of adjustment of money held to money desired.

As described above, the demand for money (desired money balances) and the supply of money (money creation via bank credit) are both dependent at every instant on the collective psychology, i.e. on the remembered influence of past conjunctures as represented by coefficient . But – and herein lies the key to explaining the instability of market economies – this influence acts in opposite directions. As every economic disturbance simultaneously influences the level of money demand and the supply of money has no opportunity to stabilize itself as it can only be amplified by the interaction of the behaviour of the various economic agents until the system meets its limits, far removed from the equilibrium position, and the mechanisms operating force an about-turn in a pendulum-like movement which can be arrested by nothing in the institutional framework within which our economies function, i.e. in the context of a banking system having fractional backing of deposits and which produces deposits by extending credit.

To clarify a few points as to how Allais’s model functions, it is sufficient to begin from a situation of equilibrium characterized by a perfect coincidence of money held with money desired () and to suppose the intervention of a jolt, in the form, for instance, of an injection of money by the banking system, irrespective of its origin (bank loan or purchase of financial assets). The sequence of events will thereupon be as follows:

- The economic agents will spend the excess money, thereby leading to an increase in global expenditure;

- Consequently, the perceived positive variation in the scenario (increase in

will bring about a twin reaction with opposite effects: a fall in relative demand for money (

) and, concomitantly, an increase in the money stock due to increased desire of the banks to lend and of economic agents to borrow; which causes the gap (

) to widen, leading to a new round of expansion of global expenditure and therefore of

… and so on;

- The expansion process will continue to develop, each increase ushering in the next, but it will inevitably tend towards certain limits (at least in normal situations): the need for money balances will continue to decline (in relative terms) but more and more slowly since economic agents will deem it risky to reduce them further without jeopardizing their cash-flow and thus exposing themselves to a jerky and expensive ride (subject to a floor constraint) whereas, from the angle of money creation, banks and borrowers, confronted with balance sheets that are increasingly strained (in terms of liquidity) and burdensome (relative to their capital), will themselves become warier and curb their expansion (ceiling);

- At this point, global expenditure will begin to slow down and even cease to increase at all, leading to a weakening of

(increasingly lukewarm feelings about the development of the scenario) with all its associated consequences: increase in the relative demand for money (

), decrease, or decelerated increase, in the money stock → fall in global expenditure

and so on … until the system meets its limits at the bottom end of the cycle, curbing the accumulation of money balances on the one hand with excess liquidity and eased balance-sheets on the other, gradually setting in place the foundations of the new upstroke.

These phases of course recount the evolution of the economic system under “normal” circumstances, when the supply of money is due to the decisions of economic agents as in a fractional reserve banking system. In this case the mathematical analysis and the empirical applications clearly show that the system is in general stable and converges towards a limit cycle. But the model also enables two cases to be elucidated which are of great theoretical importance depending on the characteristics of the money supply:

- Case 1: The supply of money runs out of control as in hyperinflation scenarios. For in such a situation, given the discrepancy between receipts and budgetary expenditure, the injection of money is no more than the resultant of the increasing budget deficits, financed by the Central Banks. In this case no restabilization process can occur and the system diverges and literally “explodes”;

- Case 2: A totally inelastic supply of money, as in a genuine gold standard system (having no fractional reserve banking) or a monetary system using fiat money but with full backing of deposits. In this case, any disturbance is self-correcting and the system spontaneously returns to equilibrium.

Study of the latter case, in the context of the general theory of monetary dynamics, was moreover to strengthen Allais’s position in favour of a radical reform of the banking system along the lines of the reform initially proposed by the Chicago school (notably Henry Simons) and championed by Irving Fisher, one of the masters admired by Allais. This conviction was further reinforced by his growing conviction that there were some economic disturbances, and therefore aggravating factors of monetary instability, which no purely economic model could ever claim to explain and therefore enable to be countered, owing to their great complexity.

The possible need to factor in a measurable unknown of exogenous nature: “the X factor” (2001)

In the 80s, Allais put forward the idea that in addition to endogenous factors, human psychology might also be influenced by phenomena of an exogenous nature, i.e. linked to physical phenomena. For as a matter of fact no explanatory model seeking to establish the relevant relationships, whatever their nature, between observable economic variables could generate the complexity of the series that are observed, “as they display such divergent periodicities: some of the order of 40 months and others of the order of 6, 9 or even 18 years or local patterns of regularity the morphology of which so strikingly reminds one of almost periodic functions” (Allais, 2001, p. 916); … in other words observations similar to those met with in the study of physical phenomena (ibid., p. 917). Naturally the difficulty which the researcher faces is how to take such phenomena into account and Allais devoted considerable thought to the impact which might be produced if a factor of quasi-periodic nature were introduced into the operation of his model of monetary dynamics. He pursued this subject almost to his dying breath, for the final FEMD application he proposed with an attempt to introduce the “X factor” goes back to the year 2000, when he was nearly 90… (ibid., Appendix, p. 1245).

Thus with the monetary theory of economic fluctuations, Allais for the first time provided the science of Economics with a functioning model that shows with dazzling force the major role played by money in generating the instability of our economies, which many of his predecessors had intuitively sensed without ever being able to demonstrate it on an empirical level or which had led them to become bogged down in inextricable controversies:

- either (a) they based their case on simple empirical correlations showing the precedence of monetary fluctuations over economic movements, whether real or nominal, (Friedman and Schwartz, 1963 ; Andersen and Jordan, 1968), but invariably exposing themselves to the “post hoc propter hoc” objection (Tobin, 1970) since there existed no theoretical model having completely specific and empirically proved behaviour, whereby to demonstrate it;

- or (b) they sought to demonstrate the exogenous character of monetary creation by supposing it possible to be controlled by the monetary authorities, which of course conflicted with everyday experience and came down to explaining crises by “mistakes” perpetrated by the Central Banks in managing monetary policies (Friedman and Schwartz, 1963, 1982).

Allais’s approach, by contrast, makes a clean sweep of all such problems, resolving them with astonishing simplicity and elegance: the creation of money is certainly endogenous to the operation of the economic system, via the bank credit mechanism, but the fact remains that by its impact on money balances (balances actually held as compared with desired balances) and on global expenditure (monetary creation is synonymous with creation of purchasing power), it is the key factor in the ongoing evolution of the economy.

And to demonstrate further its importance and complete his overview of economic phenomena, he shows that it also directs the underlying movement of the rates of interest and, through them, impacts on the growth processes of the economies.

The determination of the rate of interest and the growth process of economies in the monetary theory of Maurice Allais

Without treating in all its complexity the analysis of the rates of interest undertaken by Maurice Allais in his major contributions such as Economy and Interest (1947) and the arcana of his theory of capital, as they will be the subject of other specialist contributions, it seems useful to understand first how the explanation of the evolution of interest rates fits into his theory of monetary dynamics and secondly how the level of the psychological rate of interest can influence the optimum capital stock of an economy’s growth process.

The rate of psychological interest and the dynamics of the market interest rates

In his 1947 study Economy and Interest, Allais had already elaborated a theory of interest rates which stipulated that all the market rates could be represented as a combination of two types of determinants:

- The psychological interest rate, which expresses at every instant the “time preference” and thereby gives the general direction of the market rate;

- The various premiums and costs depending on the characteristics of the asset: its date of maturity, its liquidity, its risk level (or score in terms of risk) and the various costs involved in owning it.

|

Market and “pure” psychological interest rates (Allais, 1947, pp. 255-257)

|

|

| Equilibrium situation | |

| Definition of the market interest rates | |

With the modelling of the psychological rate of interest, Allais paved the way for operational models for the whole range of interest rates [5]. Since, for each rate of interest, depending on its maturity, market depth and debtor quality, it is appropriate to combine the first, as the main directional factor of the trend of the interest rates, with the explanatory factors of liquidity and risk premiums proper to each of them. Hence in 1977, one of his students, Jean-Jacques Durand, explained the dynamic of interest rates over a short term during two very different periods in the US, 1919-1939 (a period including the “Great Depression”) and 1947-1972 (a period including the inflation spike), by linking the difference (

) (liquidity premium) to the banks’ free reserves or unborrowed reserves, thereby obtaining an explanation of the interest rates far higher than those found in the literature with a reduced number of arbitrary parameters, the same calculated psychological rate as that derived from the money demand model (i.e. by adapting to one another two entirely different phenomena – the quantity of money and the rate of interest) and the same estimated parameters for both periods…

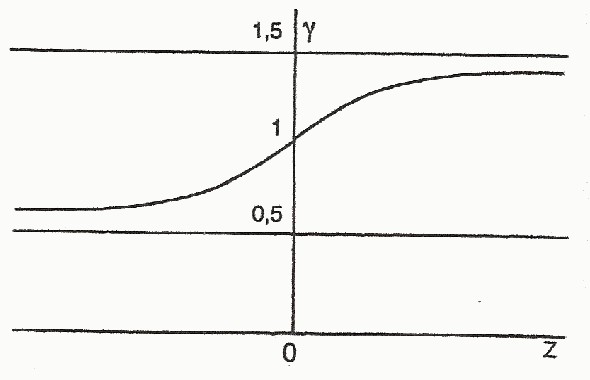

Rate of growth of global expenditure, psychological rate of interest and optimum capital stock

In the same analytical context, the reflections on the fulfilment of the conditions of the optimum capital stock, so brilliantly demonstrated for the first time by Allais (1947) [6], take on a new dimension. For the theory states that under dynamic equilibrium:

- The observed output level (

) in comparison with maximum output level (

) that can be attained using an optimum capital stock is crucially dependent on the difference (

) between the psychological rate of interest and the rate of growth in nominal income /global expenditure.

- This ratio is maximal (

) when this difference denoted by $latex u$ is zero, i.e. when

, a situation known in economics as the “Golden Rule”.

- If this is not the case the economy may be deemed to be under-capitalized if

or

, and overcapitalized if

or

[7].

Formally, the model constructed by Allais establishes that there is a linear relation between the “differential of the gross domestic product relative to its potential maximum” () and the difference (

), i.e. the differential between the psychological rate of interest and the rate of expansion of global expenditure.

This is a finding of great importance from the point of view of economic policy, especially of monetary policy. For once the conditions that form the psychological rate of interest are known, it seems possible not only (a) to have a complete theory of economic dynamics and to establish its conditions in a process of dynamic equilibrium, but also (b) to enquire whether there is not a rate of increase in global expenditure which ought to be targeted by a monetary policy if it is to be capable of satisfying the conditions of optimal growth. This brings us up against all the issues involved in the search for an optimal monetary growth, given that

depends on

which itself depends on the rate of increase in global expenditure (

)…which in turn itself depends on

.

Conclusion

Throughout his career Maurice Allais strove to show that the goal of economics is to bring to light how economic agents in fact behave, while shaking off abstract theories based on a priori behaviour patterns. Economics is first and foremost an observational science and this meticulous observation of the facts prevailing in every land and in every situation is the only process that can enable authentic theories to be constructed, i.e. explanatory models able to cover all observed cases while respecting the greatest sobriety in respect of the parameters employed.

The construction of his models of behaviour and demand for money as well as for the supply of money or the psychological rate of interest, is an example of the trail he endeavoured to blaze for economics:

- Remembrance of past phenomena: observation of statistical correlations between

and past rates of variation in global expenditure;

- Variability of the rate of forgetfulness: observation of shortening or lengthening of the periods to be taken into account in the preceding calculations as to the prevailing scenario;

- Logistic form: analysis of the shape of the

relation and the rates of variation in global expenditure, including all possible observed cases (countries, periods) in a single graphic representation;

- Parallel between forgetfulness and interest: resemblance detected between calculated forgetfulness rates and observed interest rates…

And so on… Needless to say Allais would begin by studying all the existing theories, but in practically every case none of them would stand scrutiny against the criteria of relevance he insisted on. He would retain only some patterns brought to light for certain specific cases and which any alternative method would necessarily have to reproduce and explain in a different theoretical framework.

Moreover, observation, coupled with his knowledge of economic phenomena, had given him a sharp awareness of the generalised interdependence which governs economic movements. In 1998 he stated his general conception in the following terms:

“Economic evolution is dominated at every point in time by cause-and-effect relations, but these relations of causality in fact mask an underlying interdependence which constitutes the real and deep-seated characteristic of the economy. In reality, the dependence which links state of the economy with its preceding states

, is a hereditary dependence in which

so that in equilibrium, under stationary conditions, we have

. It is clear how the relations of interdependence are related to the causal relations.” (Allais, 1998, p. 45, italics as in the original)

This phenomenon of interdependence is exactly what his theory of monetary dynamics expresses. Fluctuations in global expenditure may be explained by monetary variables (the adjustment of actual money balances to desired balances and variations in the volume of money in circulation whether or not due to the credit mechanism), but these monetary variables are themselves based on economic behaviour that is itself influenced by past fluctuations in global expenditure via the impact of the latter on the collective psychology of the economic agents.

And, led on by this background dynamic, all the observable economic variables are driven, albeit some in advance and some lagging behind with regard to the others, by a single general movement which calls for explanation – an explanation based on a purely endogenous model, such as the “fundamental equation of monetary dynamics” … in combination, perhaps, with “exogenous influences” (a factor), for there too observation of the complexity of the facts detects disturbing coincidences with the structure of a great many physical phenomena. Observation … and more observation … and rigorous analysis of the facts… Allais’s own “golden rule”.

In the light of such a voyage of exploration, leading to a complete overhaul of our understanding of monetary phenomena, it is unsurprising in the last analysis that Allais’s monetary theories should have been largely ignored notwithstanding all the empirical evidence presented and his by-the-book refutations of the handful of American researchers who attempted to cast doubt on his theory of demand for money. New ideas take time to gain ground, just as it takes time for fashionable theories to collapse one after another as we have seen happen in the wake of the 2007-8 crisis… Against the backdrop of the rubble to which their science has been reduced, many economists will undoubtedly rediscover the time-resistant tracks laid by the work of Maurice Allais.

Bibliography

I. On his scientific philosophy

Allais (Maurice): L’économique en tant que science [Economics as a science], Revue d’économie politique, January 1968, pp. 5-30.

- The Economic Science of Today and Facts. A Critical Analysis of some Characteristic Features, International Conference on Global Disequilibrium, McGill University in Global Disequilibrium on the World of Economy, edd. M. Baldassari, J. McCallum, R. Mundell, St Martin’s Press, 1989, pp. 25-26

- La passion de la recherche, Autoportraits d’un autodidacte [The passion for research – Self-portraits of a self-taught man], Éditions Clément Juglar, 2001, 487 pages (for a very general overview of Allais’s conceptions in the field of methodology and scientific research)

II. On his theories of demand for money, supply of money, rates of interest and monetary dynamics

Allais (Maurice): Économie et Intérêt [Economy and Interest], 1947, new edition 1998 including new general introduction by the author, Éditions Clément Juglar, with Introduction: 265 pages, 1947 text: 800 pages and Appréciations [Appraisals and testimonials]: 112 pages.

Allais (Maurice): Les fondements de la dynamique monétaire [The foundations of monetary dynamics], Éditions Clément Juglar, 2001, 1302 pages, including, in particular:

- A general Introduction by the author concerning his overall conceptions, and, specifically, his conception of monetary dynamics and rates of interest p. 21-214

- Articles on the endogenous generation of cyclical fluctuations, pp. 219-374: Papers presented at Innsbruck (1953) pp. 221, Uppsala (1954) pp. 253, Paris (1955) pp. 341

- Articles concerning remembrance of the past as a determining factor of the present, the hereditary and relativistic approach: La reformulation de la théorie quantitative de la monnaie [The restatement of the quantity theory of money] (1965) pp. 377, A Restatement of the Quantity Theory of Money (1966) p. 579, Forgetfulness and Interest (1972) p. 617, Summary tables (1968) pp. 653

- Extension de l’approche héréditaire et relativiste: la formulation héréditaire et relativiste de l’offre de monnaie [Extension of the hereditary and relativistic approach: the hereditary and relativistic statement of the supply of money] (1970) p. 673, La création de monnaie au cours des hyperinflations [Money creation during hyperinflations] (1970) p. 685, The Psychological rate of Interest (1974) p. 689, A New Empirical Approach of the Hereditary and Relativistic Theory of the Demand for Money (1984), Growth and Inflation (1968) p. 785, Inflation et Croissance, Tableaux de Synthèse [Inflation and Growth – Summary tables] (1968) p. 859,

- Articles et mémoires relatifs aux facteurs exogènes de la dynamique monétaire [Articles and research papers relative to exogenous factors in monetary dynamics], pp. 871-954 including: Analyse des séries temporelles [Analysis of temporal series] (1980), Structure des séries temporelles [Structure of temporal series] (1982), Facteurs exogènes des fluctuations conjoncturelles [Exogenous factors in cyclical fluctuations] (1984),….

- Mémoires et études sur la théorie générale de la dynamique monétaire [Research papers and studies concerning the general theory of monetary dynamics], pp. 955-1026 including: L’équation fondamentale de la dynamique monétaire [The fundamental equation of monetary dynamics] (1968) pp. 957, La génération endogène des fluctuations conjoncturelles [The endogeneous generation of cyclical fluctuations] (1968) pp. 969, La génération exogène des fluctuations conjoncturelles [The exogenous generation of cyclical fluctuations] (1982) pp. 1011

- Critiques addressing Allais’s theories and his replies, pp. 1027-1216, see in particular his article: The empirical Approaches of the Hereditary and Relativistic Theory of the demand for money, Results, interpretation, criticisms and rejoinders, 1985, pp. 1135-1216

- Appendices including, notably, Appendix B: Une vérification d’ensemble de l’équation fondamentale de la dynamique monétaire et de la formulation héréditaire et relativiste de la demande de monnaie [An overall verification of the fundamental equation of monetary dynamics and of the hereditary and relativistic statement of the demand for money] (2000), pp. 1245-1302

III. Some works cited in the course of this presentation

Andersen (Leonall C.), and Jordan (Jerry L.): “Monetary and Fiscal Actions: A Test of Their Relative Importance in Economic Stabilization.” Federal Reserve Bank of St. Louis Review, No 50, November 1968, pp. 11-24

Cagan (Phillip): The Monetary Dynamics of Hyperinflation, in Studies in the Quantity Theory of Money, edited by Milton Friedman, The University of Chicago Press, 257 pages, pp. 25-117

Durand (Jean-Jacques): La dynamique des taux d’intérêt à court terme, États-Unis 1946-1972 [The dynamics of short term rates of interest, US 1946-1972], Doctoral thesis, University of Paris-X Nanterre:

- La théorie héréditaire et relativiste: Application au taux d’intérêt à court terme, États-Unis 1946-1972 [The hereditary and relativistic theory: application to short term interest rates, US 1946-1972], Economie et Sociétés, Série MO, 1979

Fisher (Irving): Our Instable Dollar and the so-called Business Cycle, Journal of the American Statistical association, June 1925, pp. 179-202

Friedman (Milton) and Schwartz (Anna J.): “Money and Business Cycles.” Review of Economics and Statistics 45, February 1963, Supplement: pp. 32-64:

- A Monetary History of the United States, 1867-1960, Princeton University Press, 1963, 860 pages

- Monetary Trends in the United States and the United Kingdom, Their Relation to Income, Prices, and Interest rates, The University of Chicago Press, 1982, 664 pages

Haberler (Gottfried): “Prosperity and Depressions, A Theoretical Analysis of Cyclical Movements”: League of Nations, First Edition 1937, 532 pages ; new edition, Transaction Publishers, 5 October 2011, 530 pages as well as by the Ludwig Von Mises Institute (2011)

Keynes (John M.): The General Theory of Employment, Interest and Money, 1936, French version, Payot Paris, 1969, 407 pages

Tobin (James): Money and Income: Post Hoc Ergo Propter Hoc, The Quarterly Journal of Economics, Vol. 84, No. 2., May, 1970, pp. 301-317.

[1] I am here following the terminology used by Allais himself, for whom, at the community level, it is the whole set of transactions that must be taken into account and not only the final transactions estimated in the gross domestic product. That said, in empirical applications it is always the nominal gross domestic product which is used.

[2] This introduction of variable rates of forgetfulness depending on the conjuncture is the original contribution Allais made to economic analysis. The effects of the past were in fact recognized in the Anglo-Saxon literature under the name “distributed lags”, having been introduced for the first time by Fisher in his study of the relation between prices and rates of interest (1925) and subsequently used both by Cagan (1956) in his study of the phenomena of hyperinflation and by Friedman in his permanent income hypothesis (1957).

[3] Fisher’s equation of exchange: , therefore

, simply states that the number of times a unit of money passes from hand to hand in a given unit of time generates a flow in the value of transactions over this period and hence in the national income $latex Y$, if it is assumed that there is a certain proportionality between the former and the latter after taking the intermediate productions into account.

[4] Since the reasoning here adopts the standpoint of any agent, representative of the entire community. It is obvious that, taken individually, each person may increase his expenditure by borrowing from someone else, whether directly or via a financial intermediary, but in such cases there is no increase in expenditure at the global level since the expenditure of one is offset by retention on the part of another. Therein lies the essential difference between the creation of money and the mobilization of savings.

[5] For the long term rate of interest, see Allais (1974), pp. 285-331, or Allais (2001), pp. 691-737, and for the short term rate see Durand (1977)

[6] … but found in the literature under the name of American economist Phelps….

[7] Allais, 1969, p. 388